Just a few days ago, one personality posted on Facebook the Philippine Stock Market crashing due to the drug war being a bad investment, and pointing out that the drug war led by the current administration is causing the PSEi to go down.

|

| Figure 1: Facebook post. |

While I would not agree with his post in many sense, I would not waste my time giving lectures to him, telling him to shut up and learn about the stock market, as we all know his personality so well. Instead, I'll have to use my time studying the market, reading news about the companies, check Foreign Exchange related news, etc.

Some people would say that its the news that makes the market, while others would say that its the market that makes the news. Both have its own point, but it doesn't matter. The point here is, you should always have a PLAN whatever you do, whatever company shares you buy, there should always be a plan, and it all starts in there.

IS THE PSEi CRASHING?

We had a good run since the start of the year, with 9.06% year-to-date return. Currently, we are near crucial support at around 7500. Year-to-date flows is only around 37.6M right now, with around -19M flows for the past 30 days. That is not a good sign.

| Stock

name |

^PSEI |

| Current Price |

7581.79 |

| YTD Return |

9.06% |

| 52Wk High |

8118.44 |

| 52Wk Low |

6084.28 |

| MVWAP (10

days) |

7729.95 |

| MVWAP (20

days) |

7831.33 |

| MVWAP (65

days) |

7861.16 |

| MVWAP (252

days) |

7287.11 |

| YTD Flow |

37,625,876.00 |

| 20D Ave Volume |

9,115,808 |

| 50D Ave Volume |

9,461,655 |

| 90D Ave Volume |

9,299,764 |

Volume have been quite good so far for the index compared to last year, as most investors are in the defensive mode due to the increase of rates by FED. If you have an average of 9M volume per day, there is always a good trade in the Philippine Stock Market.

|

| Figure 2: PSEi daily chart |

In a range perspective, buy level is pegged at 7500, which is quite a strong support with a stop below 7343. But taking into account price action, you could see that it is mostly bearish, and that a buy signal will only be executed once 7500 support is held.

|

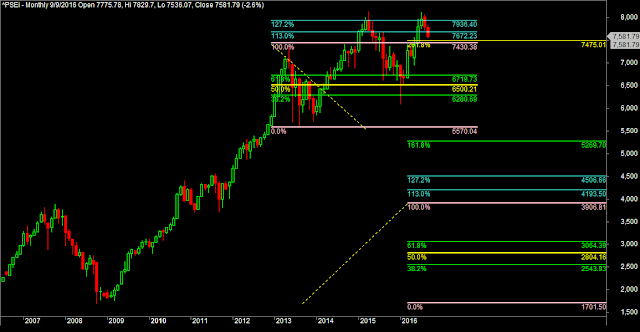

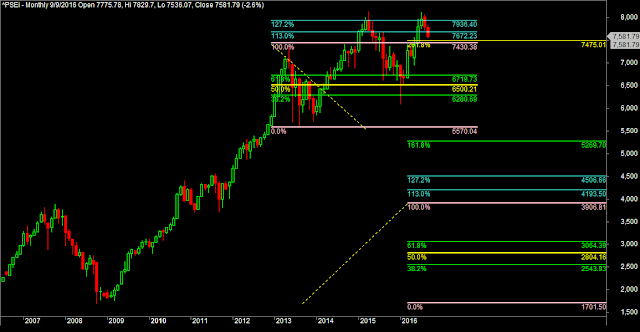

| Figure 3: Monthly Chart |

On a monthly chart, it does not look good also as you have two big red candles with you, but if you run fibonacci extensions to the chart, you will have psychological support around 7450 area.

WHAT'S THE BEST WAY TO DO RIGHT NOW?

For me, the best way you can do is to study more about technical analysis. There are a lots of books which are quite a good read for every investors, so take the opportunity to learn something. PSEi will not be in a "crash"mode (as per my vocabulary), but expect the market to be quite bearish. I would suggest you look for stocks (Non-Index, basura) which are quite not correlated with PSEi.

Be wise always. Study more.

CAVEAT!

Disclaimer:

Trading is a risky thing and the post in this site are for educational purposes only. Equities and

Forex Trading is speculative in nature and may harm every trader and

investor by losing money. Thus, do not treat this post as a

recommendation to BUY or SELL a stock or a currency pair. Blog contents

are valid only on the date of publication and will be subject to change

without notice. Thus, the reader is advised to take precaution, and is

recommended to do their own studies before pressing the BUY and SELL

buttons. I will not take any responsibility with the readers trading

results.